Submitting Secondary and Other Claims

![]() Related Training

Related Training

Submitting Secondary Insurance Claims Recorded Class

Sensei Cloud supports an unlimited number of patient insurance plans. Each patient can have one Primary, one Secondary, and multiple plans designated as Other.

-

A patient's associated insurance plans are visible from the Patient Snapshot, the Patient Home Page, and the Patient Record.

-

When submitting claims for a set of charges, it is recommended that you submit to Primary insurance first and await a response, and then submit to Secondary.

Note: Additionally, you can submit a claim to medical insurance first, await a response, and then submit a claim to a dental insurance, such as for an oral surgery practice.

-

Only one claim can be open at one time for a particular set of charges.

-

When a patient has multiple policies, the Cov column in the Claims Management windows display P for Primary, S for Secondary, or O for Other.

For effective handling of secondary or subsequent claims, it is recommended that you update the New Claim Handling rule to Hold For Review instead of Auto Transmit to prevent queueing and transmission when the payer does not accept electronic attachments. For those claims, it is recommended that you print a copy of the claim and manually submit it to the payer, along with a copy of any required EOBs and supporting documentation.

To bill procedures to multiple insurance plans:

-

From the Checkout Queue, select the patient and click Post Charges. The Post New Charges window is displayed with Bill Ins? selected for all procedures.

Note: If any procedures should not be billed to insurance at this time, deselect them.

-

In the Insurance to Bill field, the Primary plan is selected by default. You can select a different plan from the list. For example, if a dental plan is the Primary plan and you want to bill the patient's medical plan first, select a medical plan from the list. The plan billed first becomes Primary for this set of related claims.

Note: The selected policy must provide coverage for the types of services being billed, must not have been already billed for the services, and must have been active at the time of the Service Date.

-

Click Post Charges & Bill Ins. A claim is created for the designated amount, and either sent automatically or receives a status of Pending Review, Needs Attachments, or Needs Info, depending on your practice settings and the details of the claim.

Note: If the claim is not sent automatically, continue to Insurance > Claims Management to prepare and submit the claim.

-

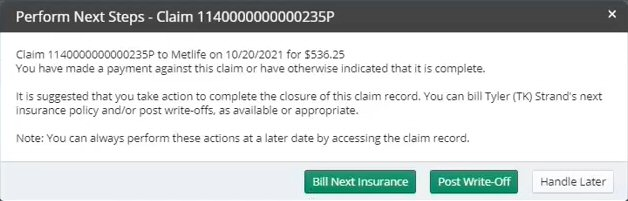

When the insurance company returns payment for the claim, post the payment. The Perform Next Steps—Claim window is displayed.

Important: You must select Insurance in the Payment Type field and then select the correct claim in the Claim Number field, so that the next claim created for these charges is properly processed.

Note: When the patient has no remaining coverage to bill and all of the expected reimbursement has been received, click Post Write-Off to resolve the remaining portion of the unpaid balance. It is recommended that you wait until all submitted claims have been adjudicated, so that the lowest acceptable write-off can be posted.

-

Select Bill Next Insurance. The Bill Next Insurance window is displayed, with all the procedures from the original claim selected by default.

-

If necessary, deselect any procedures that do not belong on this claim; for example, secondary insurance does not cover certain procedure types or primary claim has paid certain charges in full. The Insurance to Bill field defaults to the next plan in the list, but you can select a different plan, if needed.

-

Click Create Claim. The claim is created and added to the patient's Claims Management window.

Important: Secondary claims require the inclusion of the EOB from the previous payer. When processing and submitting secondary or tertiary claims, you are prompted to include EOB or other attachments. Use the Claim Summary window to prepare and submit the claim.

Setting Coverage Details and Benefits by Category on an Insurance Plan

Importing Coverage Details to an Insurance Plan

Setting Up Insurance Claim Processing

Canceling and Resubmitting Insurance Claims

Using ICD-10 Medical Diagnosis Codes and Submitting Medical Claims

Using CPT Codes for Medical Billing

Viewing Insurance Claims Statistics