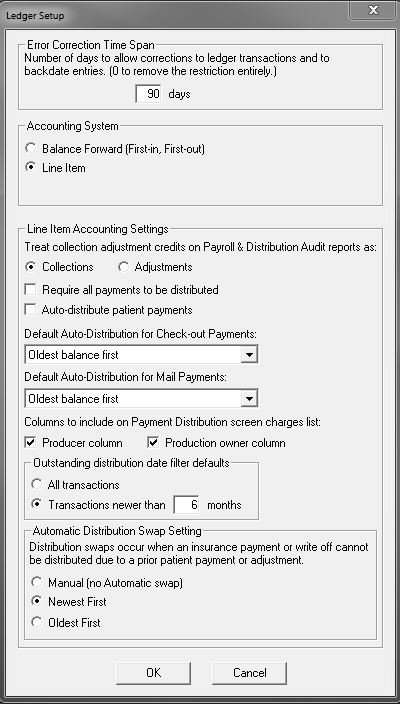

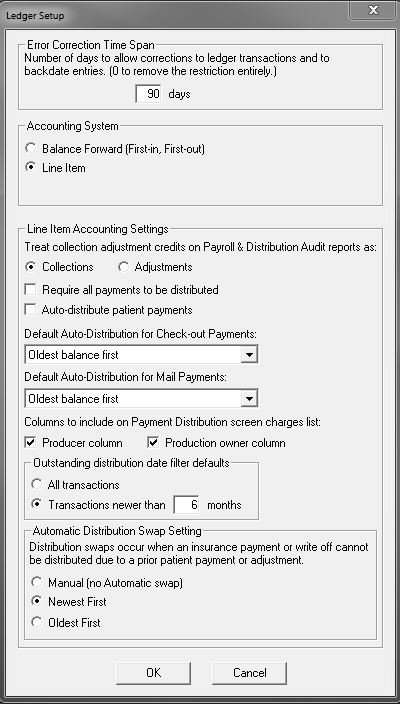

To set up the ledger for Line Item accounting:

Select File > Preferences > Ledger setup. The Ledger Setup window is displayed.

In the Accounting System section, select Line Item.

In the Line Item Accounting Settings section, select the options you want:

Set the Treat collection adjustment credits on Payroll & Distribution Audit reports as: option to:

Collections—Collection adjustment credits are processed like a cash, check, or credit card payment. The credit is paid out to the producer or production owner.

OR

Adjustments—Collection adjustments are processed as Production or Other adjustments; they are not paid out to producers.

Select Require all payments to be distributed to require that payments be distributed in full to open charges.

Select Auto distribute patient payments if you want the payments to be distributed automatically.

From the Default Auto-Distribution for Check-out Payments drop-down list, select an option.

From the Default Auto-Distribution for Mail Payments drop-down list, select an option.

Select whether to include columns for Producer, Production Owner, or both on the Payment Distribution window charges list.

Select a default option in the Outstanding distribution date filter defaults section.

Click OK.

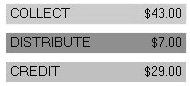

The ledger is displayed with these notifications in the upper-right corner:

The ledger uses these color codes:

Blue—Undistributed payments.

Black—Open or current charges.

Green—Comments, such as Insurance filed or Contract activated.

Red—Corrected entries. Entries appear as corrected when a transaction entered on a previous date is modified.

Using the Undistributed Payments Expert